800G DCO (Digital Coherent Optics) technology stands as a pivotal growth driver in the high-speed optical communication sector. Against the backdrop of the AI computing boom, it is catalyzing transformative changes in data centers and long-haul transmission networks. This global market analysis aims to provide a comprehensive overview of the current developments and future trends in this field.

Market Growth Drivers

Surge in AI Computing Demand: AI clusters are expanding from single-site deployments to multi-site architectures to overcome limitations in power and space. This distributed framework creates a non-negotiable demand for high-speed, long-distance interconnects, directly fueling the need for high-performance pluggable coherent optics like 800G DCO.

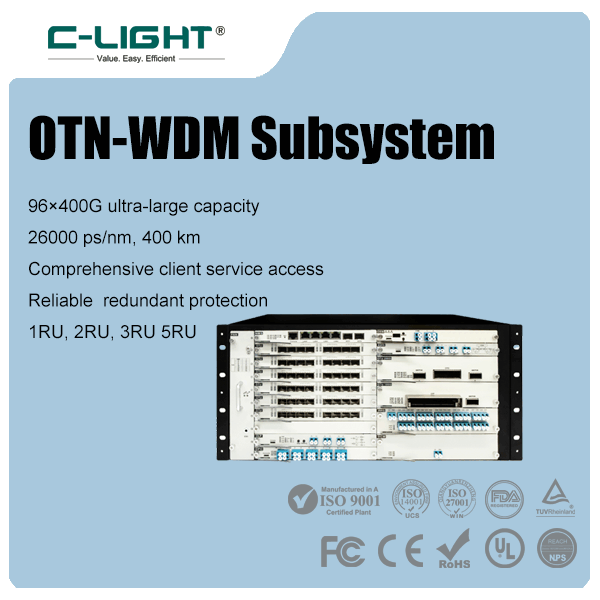

Technological Evolution and Architectural Simplification: The adoption of IP-over-DWDM architecture is a key enabler for the pluggable coherent optics market. This approach allows routers and switches to integrate DWDM optical modules directly, eliminating the need for standalone transmission equipment and significantly reducing costs and network complexity. This market is projected to grow to nearly USD 5 billion by 2029.

Clear Generational Advantages: Compared to 400G technology, 800G offers significant benefits in bandwidth density and energy efficiency. With a maturing industry chain, 800G optical module shipments are forecasted to increase by 60% year-over-year in 2025, making it one of the fastest-growing segments.

Global Regional Market Landscape

The global 800G DCO market exhibits distinct regional characteristics, with varying growth drivers and performance across geographies.

North America leads the global market, holding the largest share of 36%. Growth in this region is propelled by large cloud service providers (e.g., Amazon, Meta) actively deploying 800G/1.6T technologies.

Asia-Pacific is the fastest-growing region, with a projected compound annual growth rate (CAGR) of approximately 18%. The Chinese market is particularly dynamic, with local enterprises playing critical roles in the supply chain.

Europe is experiencing steady growth, as telecom operators focus on their core markets through asset restructuring, while demand for high-speed connectivity in data centers continues to rise.

Industry Chain and Competitive Landscape

The competition in the 800G DCO market spans the entire industry chain, from core chips and optical components to module manufacturing.

Core Chips as the Foundation: The 800G DSP (Digital Signal Processing) chip is central to achieving high-speed transmission. The global market for 800G DSP chips was valued at approximately USD 77 million in 2024 and is expected to reach USD 193 million by 2031, growing at a CAGR of 13.6%. Key players in this segment include Credo, Marvell, MaxLinear, and Alphawave Semi.

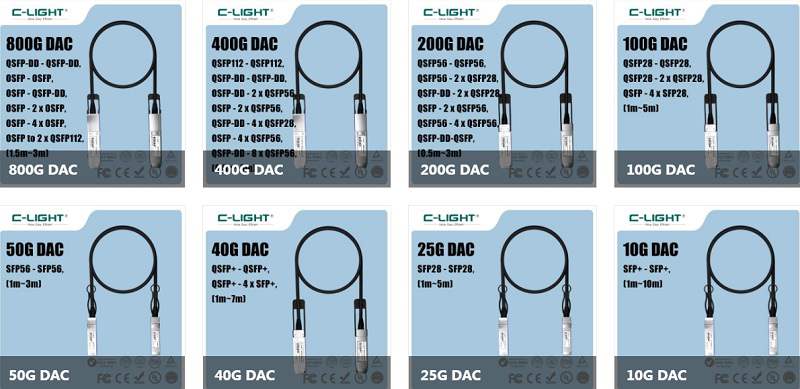

Fierce Competition in the Module Market: The global 800G DCO transceiver market is highly competitive. The mainstream form factors for these products are QSFP-DD and OSFP.

Future Trends and Challenges

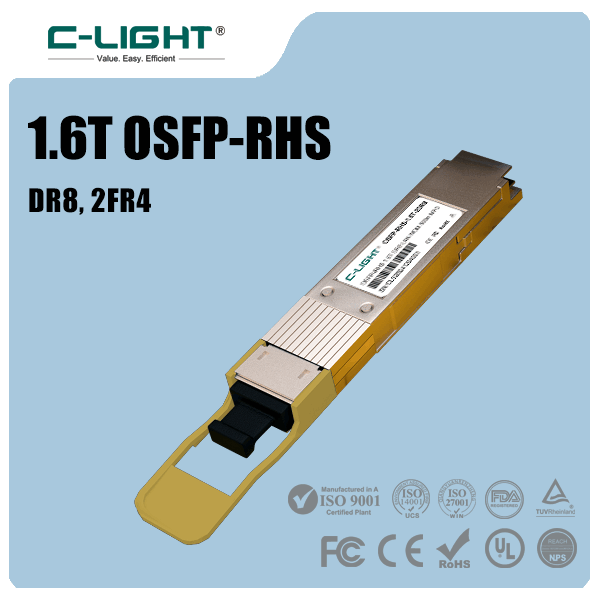

Trend 1: Evolution to 1.6T and Beyond: The initial small-scale shipments of 1.6T optical modules began in Q2 2025, marking the next phase of technological advancement. Silicon photonics are expected to capture 70-80% of the 1.6T market.

Trend 2: Continuous Performance Breakthroughs and Architectural Exploration: 800ZR+ modules, which support longer transmission distances, are gaining traction. For instance, Meta has started using this technology to connect geographically dispersed data centers. In terms of packaging, while CPO (Co-Packaged Optics) attracts significant attention, its high maintenance costs and technical complexities mean it will not pose a substantial threat to pluggable optics within the next three years. NPO (Near-Packaged Optics) is considered a more viable transitional solution.

Practical Challenges: Market growth faces constraints such as supply shortages of key optical chips like EML, which limit the production capacity of global 8-channel optical modules. Additionally, achieving full interoperability between equipment from different vendors remains a work in progress. Power consumption and thermal management are also critical challenges in high-density deployments of high-speed modules.

TEL:+86 158 1857 3751

TEL:+86 158 1857 3751

>

>

>

>

>

>

>

>

>

>

>

>