According to the latest industry survey, the global Dense Wavelength Division Multiplexing (DWDM) market is approaching a critical turning point, driven by the maturation of 400ZR coherent pluggable optical modules.

Over the next three years, 59% of 400G and higher-speed pluggable modules will be deployed in IPoDWDM equipment, with only 41% remaining in traditional transport systems. This data represents a complete reversal from the situation in 2022, marking the official transition of IP and optical convergence technology from the experimental stage to mainstream deployment.

01 Technology Evolution and Architectural Shifts

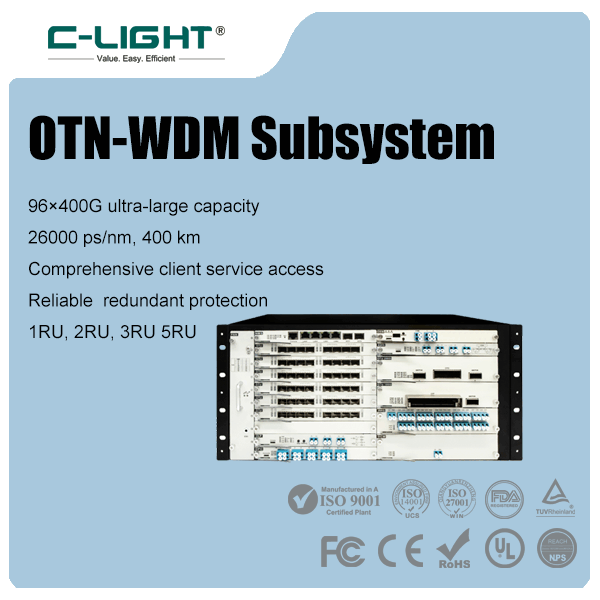

The introduction of 400ZR coherent pluggable optical modules has unlocked the IPoDWDM market. This technology is driving profound changes in network architecture.

These pluggable coherent optics can be deployed in traditional optical transport equipment or directly within routers and switches, which is the core concept of the IPoDWDM architecture.

While hyperscale internet companies were the initial drivers, communication service providers are now rapidly adopting this approach.

On the hardware front, 800G technology has become a key industry focus. The Optical Internetworking Forum (OIF) completed the 800ZR standard in October 2024. Coupled with a maturing supply chain, 43% of operators plan to deploy 800G coherent pluggable modules within one year.

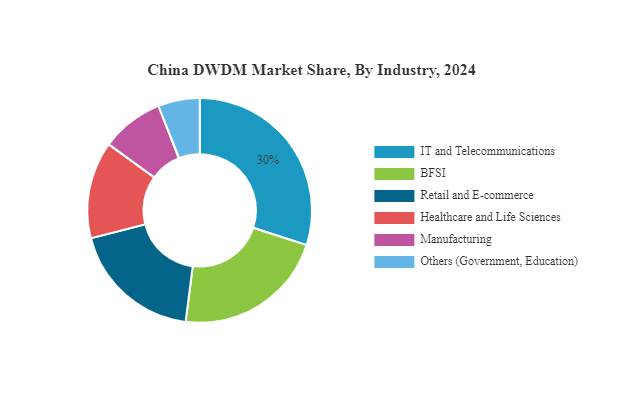

02 Competitive Landscape and Regional Hotspots

The global DWDM equipment market is highly competitive. Key players include Cisco, Ciena, Infinera, Fujitsu, Nokia, Huawei, ZTE, and FiberHome.

The Chinese market is particularly active, with 400G port shipments increasing by 230% year-on-year. Penetration in data center interconnect scenarios has already reached 47%.

Tests by China Mobile showed that Huawei's 400G QPSK solution achieved a transoceanic transmission distance exceeding 6,000 km. Compared to traditional 100G solutions, it offers a 4x capacity increase while reducing cost-per-bit by 52%.

Continuous technical breakthroughs are also emerging. FiberHome's C+L band expansion equipment has achieved 12 THz spectrum utilization, doubling the capacity of the conventional C-band.

In deployments within the Yangtze River Delta hub cluster, the number of concurrent wavelengths per fiber has reached 192, supporting a per-fiber transmission capacity evolution towards 100 Tbps.

03 Future Trends and Outlook

Over the next five years, the 400G DWDM market is expected to witness three major disruptive trends:

Coherent technology extends downward, bringing DWDM into access networks for the first time.

AI-powered optical networks enable predictive fault detection and intelligent operational maintenance.

Hollow-core fiber breaks through traditional capacity limits.

Latest research indicates that over 200 separate 400G DWDM systems will be required between major hub nodes, driving direct equipment investment to the tens of billions of dollars. The market for optical communication integrated circuit chipsets will grow accordingly, projected to increase at a compound annual growth rate (CAGR) of 18% from 2022 to 2028.

The optical communication chip market is also set for rapid growth alongside the proliferation of 400G DWDM. Industry analysts forecast that sales of optical communication IC chipsets will grow from approximately $2.6 billion in 2022 to nearly $7 billion in 2028.

This data strongly indicates that the global 400G DWDM market will maintain its rapid development trajectory for the foreseeable future.

TEL:+86 158 1857 3751

TEL:+86 158 1857 3751

>

>

>

>

>

>

>

>

>

>

>

>