Spurred by surging demand for data center interconnects and AI infrastructure, high-speed optical communication technology is rapidly evolving. 800G Digital Coherent Optics (DCO) technology is emerging as a new engine for the optical communication market.

The global optical communication market is experiencing a wave of technological upgrades, represented by 800G DCO transceivers. Market research data indicates that the global 800G DCO market size reached approximately $9.2 billion in 2024 and is projected to grow to $15.6 billion by 2031, reflecting a compound annual growth rate (CAGR) of 7.9% during this period. This growth is primarily driven by global data center upgrade requirements and the continued expansion of AI computing investment.

01 Market Enters the Fast Lane

2025 has become a pivotal year for the development of 800G DCO. Although the global optical communication market remained flat overall in Q1 2025, Q2 is expected to see a sequential growth of 10%, primarily driven by robust demand for 800G optical modules from data centers.

Forecasts predict that 800G optical module shipments will increase by 60% year-over-year in 2025, making it one of the fastest-growing segments for the year. 800G products are gradually ramping up volume production in 2025, becoming a significant component of corporate sales revenue.

With continuous advancements in cloud computing, big data, and artificial intelligence technologies, the demand for high-speed data transmission in data centers has grown exponentially, directly propelling the evolution of optical module technology towards higher rates.

02 Technical Advantages and Application Scenarios

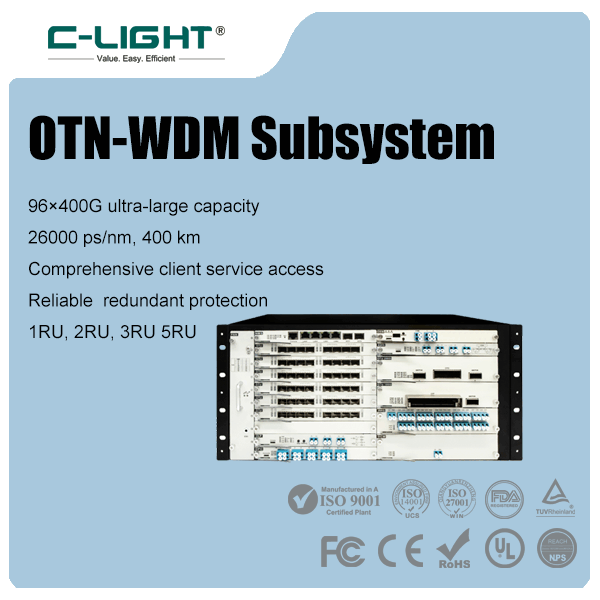

800G DCO transceivers represent not just an improvement in transmission rate but an innovation in technical architecture. They support various Dense Wavelength Division Multiplexing (DWDM) applications, including Data Center Interconnect (DCI), supporting fiber transmission distances of up to 120 km, and over 500 km for metro/regional networks.

DCO technology, which combines Digital Signal Processing (DSP) and coherent detection, provides stable signal quality at higher transmission rates and over longer distances. This makes it highly suitable for meeting the demands of modern data centers and carrier networks for high-speed, low-latency, and long-term stable transmission.

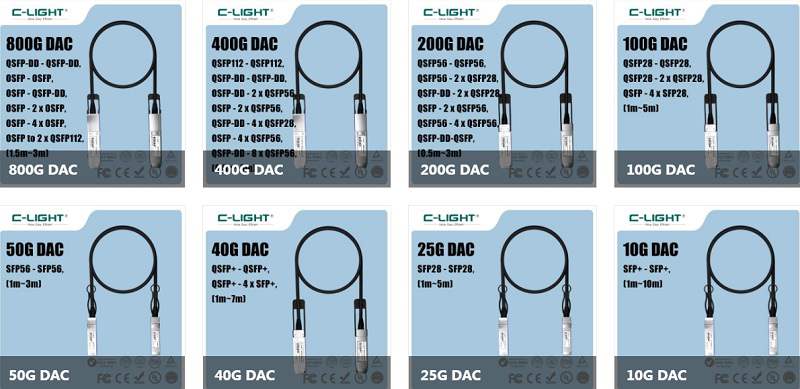

In terms of form factors, 800G DCO transceivers primarily adopt QSFP-DD and OSFP specifications to meet the needs of different application scenarios.

03 Demand Drivers

AI training and general computing needs are the core forces driving the growth of the 800G DCO market. The data center optical component market revenue is expected to exceed $16 billion in 2025, representing a year-over-year increase of over 60%. Spending on infrastructure by tech giants is rising across the board.

In Q1 2025, infrastructure expenditures from the five major tech companies—Google, Amazon, Meta, Microsoft, and Oracle—were all higher than the same period last year. Notably, Oracle's capital expenditure surged by 233% YoY to $5.6 billion.

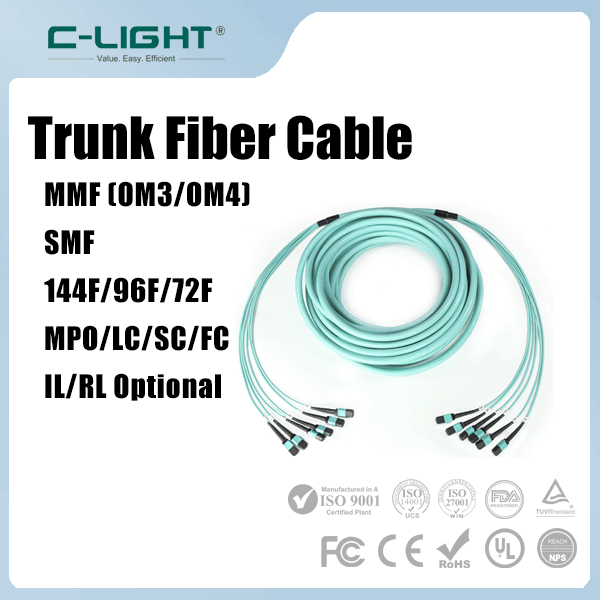

These investments substantially drive demand growth for high-performance optical modules, high-speed optical cables, couplers, connectors, and other products, creating a positive ripple effect throughout the entire optical communication industry chain.

04 Industry Chain Dynamics

All segments of the optical communication industry chain are actively responding to the rapid growth of the 800G DCO market. Financial reports from companies across the chain—from chips and optical fibers to optical modules—reflect strong market demand and proactive technology planning.

Linear-drive Pluggable Optics (LPO) technology is anticipated to become mainstream within the next one to two years. Regarding production capacity, major global manufacturers are actively expanding capacity for 800G DCO-related products to cope with persistently growing market demand.

05 Future Trends Outlook

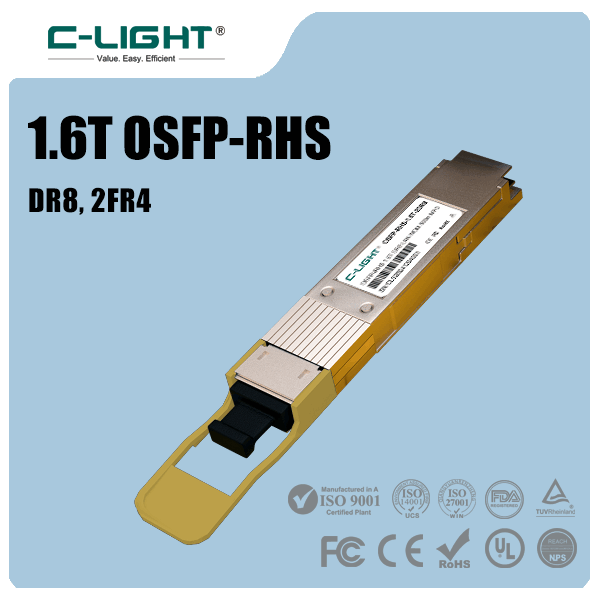

1.6T technology has become the next competitive focus. The optical module market in Q2 2025 will be primarily driven by growth in 800G modules; however, initial small-volume shipments of some 1.6T optical modules will also commence, beginning to contribute to revenue.

Although 1.6T modules will begin their journey in 2025, annual shipments for the year are not expected to exceed 1 million units, thus having a limited impact on the overall market structure, which will still be dominated by 400G and 800G modules.

While Co-packaged Optics (CPO) technology continues to garner industry attention, analysis suggests that CPO will not substantially impact pluggable optical module shipments within the next three years. During 2025-2026, 400G and 800G products will maintain their position as the primary volume drivers until the widespread adoption of 1.6T.

Over the next six years, the global 800G DCO market is expected to maintain a CAGR of 7.9%. Companies within the optical communication industry chain are generally optimistic about growth in the next quarter and the long term.

TEL:+86 158 1857 3751

TEL:+86 158 1857 3751

>

>

>

>

>

>

>

>

>

>

>

>