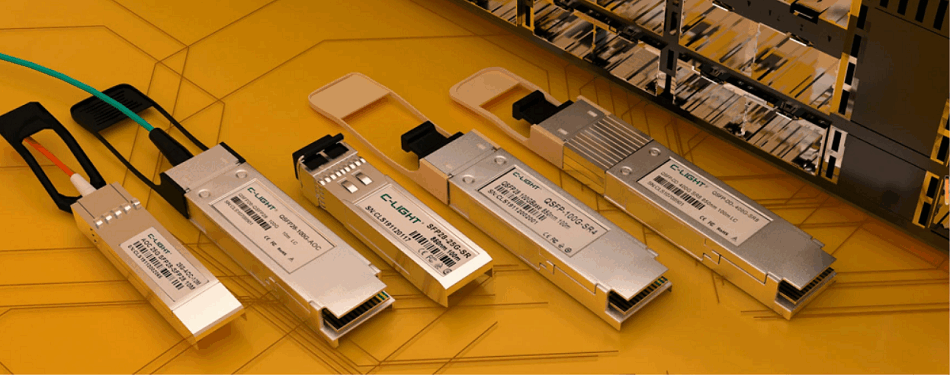

Within data centers, bandwidth is experiencing explosive growth. In 2024, deployments of high-speed optical transceivers (400G and above) surged by 250% year-over-year, with a further increase of over 50% anticipated for 2025. Concurrently, 22.5 million optical transceivers were deployed in 2024, a figure expected to rise to 34.5 million in 2025.

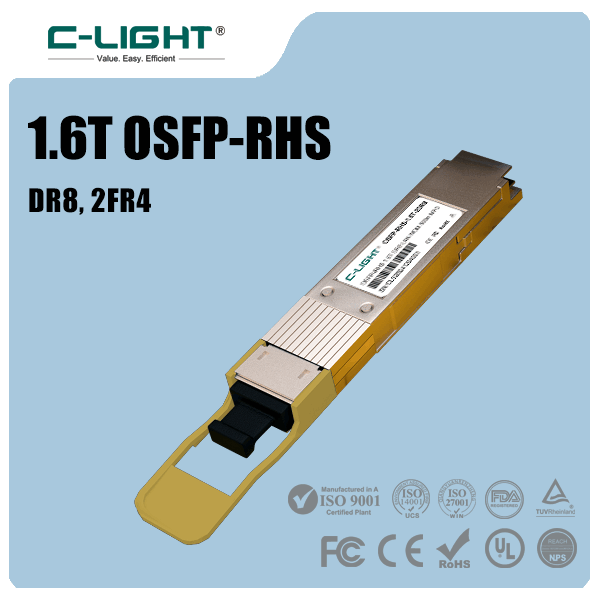

Furthermore, driven by escalating demands from AI technology, shipments of 800G optical transceivers are projected to grow by 100% year-over-year in 2025. The market will also see the initial shipments of 1.6T transceiver, while 3.2T modules are expected to commence shipping in 2029.

Notably, as transceiver shipments climb rapidly, prices are forecast to decline sharply. Typically, large-scale contracts require semi-annual price negotiations, and the price per Gbps is expected to approach $0.50 by 2027. The high-speed optical transceiver market is projected to reach $14 billion in 2025 and grow to approximately $24 billion by 2029.

Spurred by AI, the telecommunications market is also showing signs of recovery. As the power consumption of individual AI factories continues to increase, deploying AI training and inference across geographical distances using pluggable coherent optics significantly enhances efficiency. In this context, shipments of 800G ZR/ZR+ modules are forecast to exceed 200,000 ports by 2026, with 1.6T ZR/ZR+ modules expected to emerge between 2027 and 2028. The coherent optics market is anticipated to grow from $5 billion in 2025 to $8 billion in 2028. Additionally, the transport market is gradually shifting towards IP-over-DWDM technology, which is projected to account for over 50% of related revenue by 2028.

The advantages of Co-Packaged Optics (CPO) lie in its potential for lower cost, reduced power consumption, and higher density, with scale deployment expected within the next 5-6 years. However, realizing this potential requires addressing key challenges such as vendor lock-in, maintainability, and reliability. Currently, several companies, including NVIDIA, Broadcom, Cisco, and Intel, have reached the technology demonstration stage for CPO products, with some having launched initial generations. While the current market remains relatively small, its potential is significant, and NVIDIA is actively promoting CPO to reshape the industry landscape.

Coherent-Lite technology, offering advantages in lower cost and power consumption and typically utilizing the O-band, is primarily suited for 2km and 10km reach applications. Its current market share is modest, but it holds promise for adoption in future 3.2T modules. Numerous companies are actively building relevant supply chains and infrastructure to support its development.

TEL:+86 158 1857 3751

TEL:+86 158 1857 3751

>

>

>

>

>

>

>

>

>

>

>

>